How to find your ITIN number is a common concern for many taxpayers who are not eligible for a Social Security Number but still need to comply with U.S. tax laws. An ITIN (Individual Taxpayer Identification Number) is essential for filing tax returns, opening certain financial accounts, and meeting legal obligations.

If you’ve misplaced or lost your ITIN, there are clear steps to recover it—such as checking past IRS correspondence, reviewing tax returns, or contacting the IRS directly. This guide also explains what to do if your ITIN is lost, how to protect it from misuse, and the role of professional consulting firms in helping you obtain or retrieve your number securely.

Contents

- 1 What is ITIN? How to Find Your ITIN Number?

- 2 How to Find My ITIN Number?

- 3 How to Make Online ITIN Application?

- 4 What Do I Do If I Lose My ITIN Number?

- 5 How Does a Professional Consulting Firm Get Your ITIN Number?

- 6 How Much Does It Cost to Get an ITIN Number?

- 7 Frequently Asked Questions About to Apply for an ITIN

What is ITIN? How to Find Your ITIN Number?

An Individual Taxpayer Identification Number (ITIN Number) is a tax processing number issued by the tax collection agency. ITIN number help individuals comply with U.S. tax laws. It is necessary to efficiently process and account for tax returns and payments for those who are not eligible to receive a Social Security number (SSN).

The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but do not have and are ineligible to receive a Social Security number (SSN).

How to Find My ITIN Number?

Finding your ITIN number is essential for filing taxes and staying compliant with IRS requirements. Since the IRS does not provide an online tool to check ITINs, individuals need to rely on alternative methods. By reviewing official documents, contacting the IRS, or checking previous tax returns, you can easily locate your ITIN.

Check the Approval Letter to Find Your ITIN Number

When trying to recover your Individual Taxpayer Identification Number, the easiest way is to check the approval letter for ITIN sent by the IRS. This official notice contains your assigned ITIN and serves as the most reliable proof of your number.

IRS Confirmation Notice

When you apply for an ITIN, the IRS sends a confirmation letter once the application is approved. This letter includes your assigned ITIN number and serves as an official record. If you cannot locate your ITIN elsewhere, reviewing this document is the first step.

Importance of Keeping Records

Keeping the approval letter in a safe place ensures you won’t have to search for your ITIN later. Many people misplace the notice, which makes retrieving the number more difficult. Always file important IRS documents with your tax records for easy access.

Requesting a Copy to Find Your ITIN Number

If you lost your ITIN approval letter, you may request a copy directly from the IRS. Contacting their helpline can help you verify your identity and retrieve the details. This ensures you have an official source for your number.

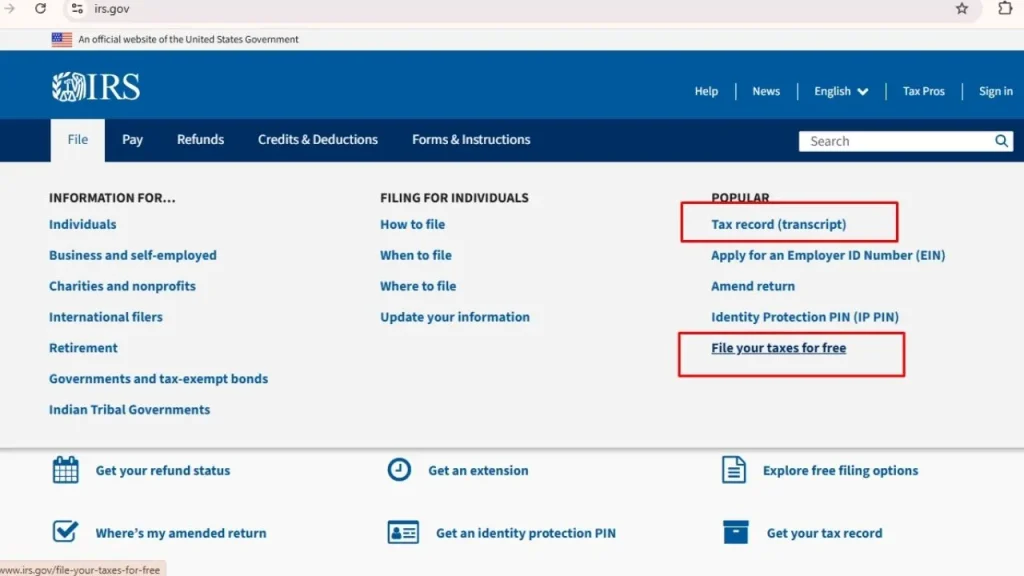

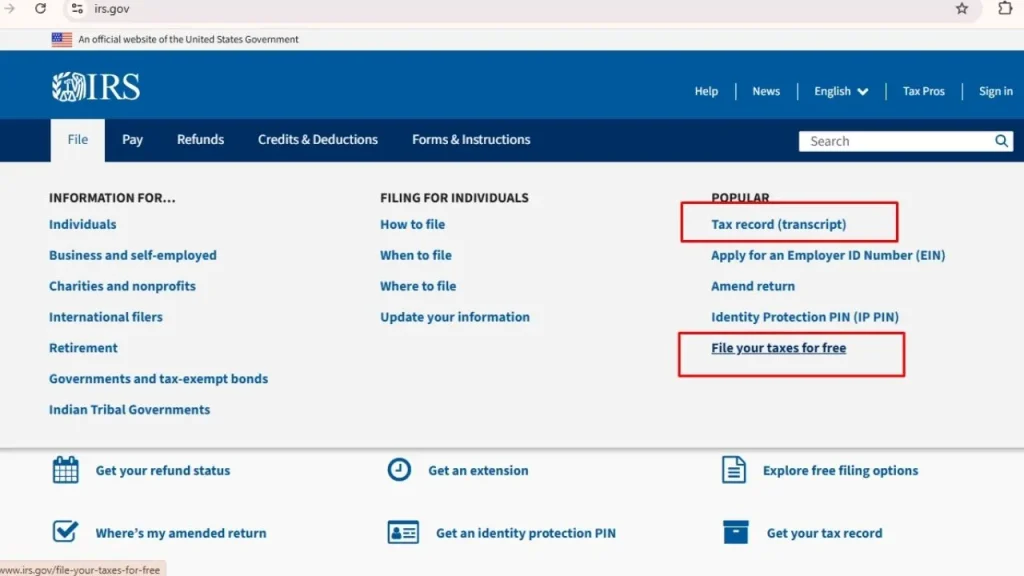

Contact the IRS

Another effective way to recover your ITIN is to contact the IRS directly through their official support channels. Whether by phone or in-person at a Taxpayer Assistance Center, the IRS can securely verify your identity and provide your ITIN.

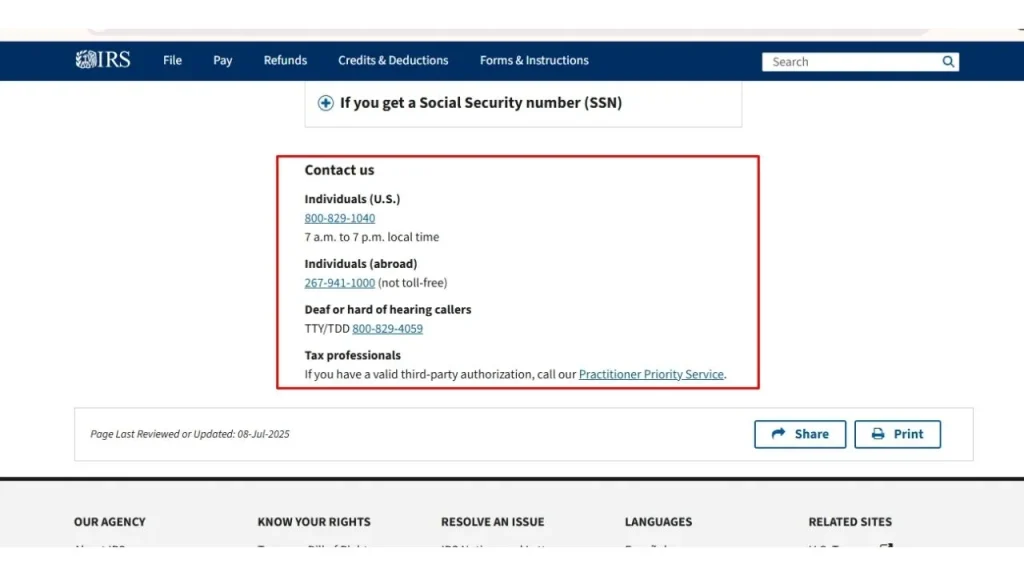

Contact to Phone Assistance to Find Your ITIN Number

You can call the IRS at 1-800-829-1040 for assistance in retrieving your ITIN. This service is specifically designed for individuals who cannot find their number in personal records. Be prepared to provide identifying details for verification.

Taxpayer Assistance Centers

Visiting a local IRS Taxpayer Assistance Center is another way to recover your ITIN. In-person verification helps ensure your information remains secure. You may need to schedule an appointment before visiting.

Security of Information

The IRS prioritizes protecting your personal information when handling ITIN inquiries. This is why phone or in-person communication is required rather than online tools. Always make sure you are contacting official IRS channels.

Use Tax Documents

One of the simplest ways to locate your number is to use tax documents to find your ITIN. Past tax returns and IRS correspondence often contain your ITIN, making them a reliable source for recovery.

Tax Return Forms to Find Your ITIN Number

Your ITIN is usually listed on your tax return forms such as Form 1040, 1040A, or 1040EZ. You can find it in the upper right-hand corner of the document. Reviewing past filings is often the quickest way to locate your number.

Previous Correspondence

Any past correspondence from the IRS related to taxes or ITIN applications may include your number. Letters, notices, or updates often have it listed for reference. Checking your old mail or digital records can help you find it.

Importance of Verification

After locating your ITIN, ensure it matches official IRS records. Using an incorrect or outdated number can cause tax filing issues. Always confirm with the IRS if you are unsure.

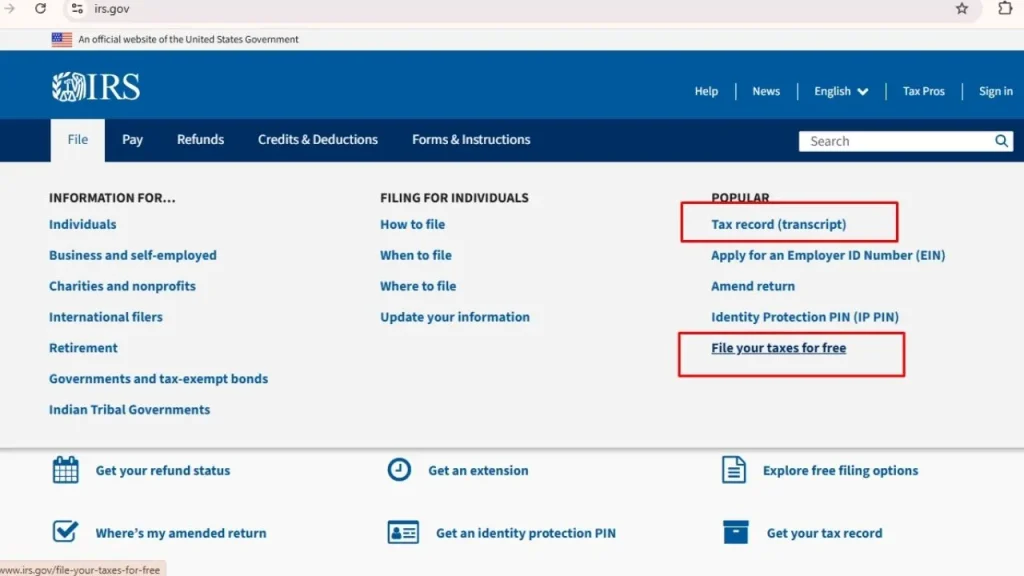

How to Make Online ITIN Application?

The online ITIN application process is offered to users to go through a different application process than traditional methods. It is an easy and effective way to apply for ITIN. Note that the online ITIN application process varies depending on the specific online portal and system used by the IRS. It is necessary to follow the instructions and adhere to any guidelines or requirements specified during the application process. If a problem arises, the Federa Revenue Service should be contacted.

The process includes;

- Visit the official website and navigate to the online ITIN application portal.

- Create an Federa Revenue Service online Account that allows you to securely access a variety of Federa Revenue Service online services, including the ITIN application.

- Start the ITIN application process by selecting the appropriate option or form.

- Enter your Personal Information with accurate personal information, including your full name, postal address, date of birth, and other required details.

- Upload scanned copies or images of supporting documents required to establish your identity and foreign status.

- Double-check all information entered and documents uploaded for accuracy and completeness.

- After you apply, you may receive a confirmation message stating that your application has been successfully received by the IRS. You need to save this information for later use.

- The Federa Revenue Service will review your online application. The processing process may take time.

- Once your application is processed and approved, they will assign you an ITIN.

Documents Required for Online Application to ITIN

To obtain an Individual Taxpayer Identification Number ( ITIN number), applicants must provide sufficient evidence to verify both their identity and alien status. This verification process is important for security measures and serves to protect individuals against identity theft. To complete the application process successfully, all documents required by the IRS must be submitted accurately and completely.

Documents requirements for online application include;

- Identity proof

- Proof of Foreign Status

- Supporting Documents for Dependents

- Document Validity

- Sworn Translations

- Document Upload

- Verification process

Security Measures for Online Application

All measurements are for the benefit of users. Security measures are implemented for online applications to protect sensitive information and guard against unauthorized access or misuse. All internet users need to be aware of online security, not just during the ITIN number application process.

| Security Measures | Details |

| Encryption | Uses encryption technology to secure data transmission between the user’s device and IRS servers. In this way, unauthorized persons are prevented from accessing important information such as personal information and documents.

|

| Data Protection and Privacy Policies | To prevent identity theft, the revenue department uses strict data protection protocols. Security policies ensure compliance with relevant laws and regulations.

|

| User Education | Guidance and resources are provided by the revenue department to educate users on online security best practices.

|

| Secure Access | Log in with authentication. Users may be required to create an revenue department online account with strong authentication measures, such as multi-factor authentication (MFA), to verify their identity before accessing the application portal.

|

| Compliance Standards | The Internal Revenue Service adheres to industry best practices and compliance standards for online security, such as the Federal Information Security Administration Act (FISMA) and the National Institute of Standards and Technology (NIST) cybersecurity framework. |

| Secure Document Upload | Uploaded files are encrypted and stored securely on internal revenue service servers. |

| Monitoring and Auditing | The IRS continually monitors and audits its online systems to detect and mitigate potential security threats |

Receiving and Using ITIN

When filing a tax return, individuals with an Individual Taxpayer Identification Number (ITIN) must enter their I ITIN number in the Social Security Number (SSN) field on the tax form. After entering the ITIN, they must complete the remainder of the tax return and submit it along with additional forms to the revenue department (IRS).

Different Application Methods to Find My ITIN

If taxpayers choose not to use or do not have access to online services, alternative methods are available to apply for an Individual Taxpayer Identification Number (ITIN). Applicants have the option of submitting ITIN number applications by mail or in person; Both of these are valid and simple methods. Those who prefer to file in person can visit the revenue department Taxpayer Assistance Center (TAC). TACs provide in-person assistance from revenue department representatives who can assist with filling out forms and submitting documents.

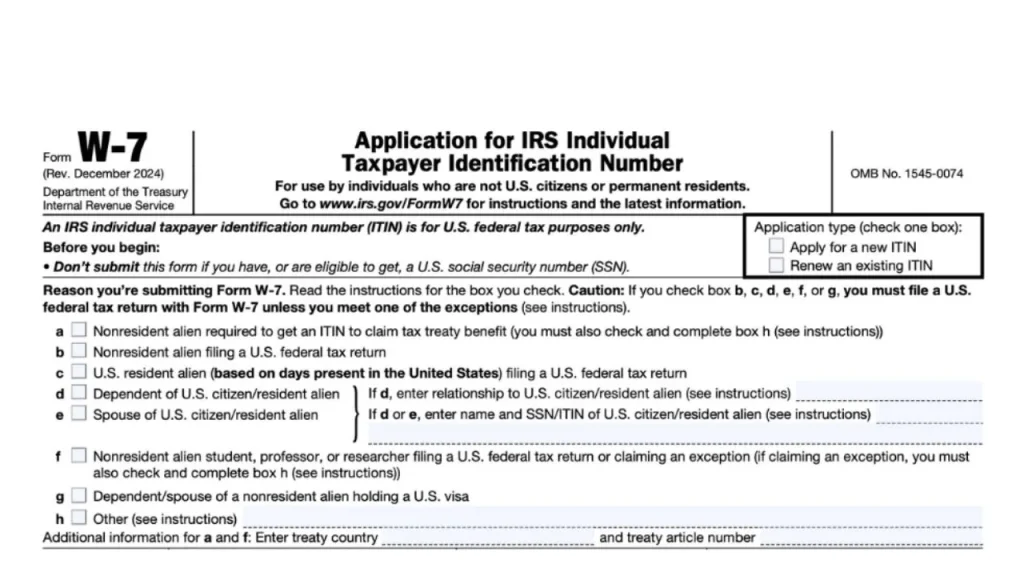

Taxpayers, on the other hand, prefer the second option to apply by mail. They must complete Form W-7, attach the necessary documents to verify their identity and alien status, and mail the application to the IRS address specified in the form instructions.

You need to be aware that each filing method to find your itin number, whether online or by mail, may involve factors such as processing times and possible delays. Therefore, it is recommended that you consult the tax agency guidelines and instructions for each application method to ensure a smooth process.

What Do I Do If I Lose My ITIN Number?

If you have lost your Individual Taxpayer Identification Number (ITIN), you can be an unnerving experience, especially during the hectic tax season. This unique processing number is a pivotal piece of your financial identity in the United States, and its importance cannot be overstated. With potential tax implications on the line, you may find yourself in a scramble, wondering “What do I do if I lose my ITIN number?”

Not to worry—there are clear steps you can take to promptly handle this situation. Beginning with understanding the significance of your ITIN, this post will navigate you through the immediate actions to take, and guide you through the recovery process including the documentation needed, how to deal with any tax-related consequences, and tips on how to protect your ITIN moving forward.

The Steps to Take Immediately After Realizing Your ITIN is Lost

Discovering that your ITIN (Individual Taxpayer Identification Number) is lost can be unsettling. However, with prompt action, you can mitigate potential problems. Here’s what you should do immediately:

How to Recover Your ITIN?

How to find your itin number? How to recover it? Realizing that you’ve lost your Individual Taxpayer Identification Number (ITIN) can be unsettling, But the recovery process is straightforward. If you’re asking yourself, “What Do I Do If I Lose My ITIN Number?”, here are the initial steps to help you reclaim it:

Contact the IRS Immediately

- Reach out to the Internal Revenue Service (IRS) at the ITIN Operation’s toll-free number. Let them know that your ITIN is lost, and they will guide you through the recovery process.

Fill Out Form W-7

- Complete IRS Form W-7, the application for requesting an ITIN. Even though you’re not a first-time applicant, this form is necessary for recovery.

Provide Identity Verification

- Collect necessary identification documents to verify your identity. The IRS will require these to ensure that they’re reinstating the ITIN to the correct individual.

The process can take several weeks, so it’s crucial to act quickly to minimize any disruptions to your tax filings or financial activities. If you’re unsure about any steps, consider consulting a tax professional who can provide guidance tailored to your situation. Remember, beginning the ITIN recovery promptly is the key to resolving this issue efficiently.

Necessary Documentation for Retrieving Your Lost ITIN

After establishing the importance of rectifying a lost ITIN situation, compiling the necessary documentation is crucial for a smooth recovery process. When preparing to retrieve your lost ITIN, you will need to gather several key forms of identification and supporting documents:

- Form W-7: This IRS application is essential for requesting a replacement ITIN. It must be completed accurately and in full.

- Proof of Identity: Supply a government-issued ID, such as a passport, driver’s license, or state ID card, to confirm your identity.

- Tax Return: You may need to attach your federal tax return, unless you qualify for an exception. Validating your tax obligations helps verify the need for an ITIN.

- Residency Status: Non-U.S. citizens should provide proof of U.S. residency, if applicable, such as a visa or green card.

- Additional Documents: In some cases, you may need to show original documents or certified copies from the issuing agency for identification purposes.

Make sure all documents are current and valid. Unclear photocopies or expired IDs could delay the recovery of your ITIN number. As you organize your paperwork, maintain a meticulous record of all documents sent to the IRS. This step ensures you can track and reference them if needed during correspondence or follow-ups regarding your application.

Integrating these documents into your ITIN recovery strategy will fortify your request and expedite the restoration of your ITIN, minimizing potential tax implications.

Dealing with Potential Tax Implications of a Lost ITIN

Losing your Individual Taxpayer Identification Number (ITIN) can be a source of considerable stress, mainly due to the tax implications that could arise. It’s crucial to tackle the issue promptly to minimize any negative tax consequences to find your itin number.. Here’s what you need to know:

| Action | Description |

| Immediate Reporting | Contact the IRS immediately to inform them of your lost ITIN. This proactive step reduces the risk of tax fraud and related legal issues. |

| File Taxes Without Delay | Don’t let a lost ITIN stop you from filing taxes. Submit your return on time using Form 4852 as a substitute for the missing W-2. |

| Prevent Penalties | Clearly explain the lost ITIN situation in your tax return to avoid penalties for not including an ITIN. |

| Amended Returns if Necessary | Once you recover your ITIN, review past filings and submit amended returns if any inaccuracies occurred due to the missing ITIN. |

Remember, the key is to act swiftly to avert any complications with the IRS. Follow these steps, and you can minimize the impact on your tax situation even when faced with the question, “What do I do if I lose my ITIN number?”

How to Safeguard Your ITIN in the Future

After wrestling with the question, “What do I do if I lose my ITIN number?” you’ll want to take steps to ensure it doesn’t happen again. Your ITIN (Individual Taxpayer Identification Number) is a crucial piece of identification for tax purposes, and keeping it secure is vital to avoiding potential fraud or delays in tax processing. Here are some preventive measures to help safeguard your ITIN:

| Preventive Measure | Description |

| Create Digital and Physical Copies | Store copies of your ITIN in a safe or deposit box, and keep encrypted digital copies in a trusted cloud service or on an external drive. |

| Limit Exposure | Avoid carrying your ITIN card with you and only share it when absolutely necessary, such as on tax documents or with a verified tax professional. |

| Use Strong Passwords | For online accounts storing your ITIN, use robust and unique passwords. Enable multi-factor authentication for extra security. |

| Regular Monitoring | Check your tax records and credit report regularly for any unauthorized activity that may indicate misuse of your ITIN. |

| Immediate Updates | Notify the IRS promptly of life changes, such as marriage or change of address, to prevent mismatches or confusion. |

By integrating these habits, you can markedly reduce the risk of losing your ITIN and steer clear of the hassle and anxiety that comes with having to recover or replace it.

Consulting with a Tax Expert

There are times when managing your ITIN (Individual Taxpayer Identification Number) (file your tax return) issues is straightforward, but in other instances, it’s wise to seek professional help. Knowing when to consult with a tax expert is crucial, especially if you’re asking yourself, “What do I do if I lose my ITIN number?” Here’s a quick guide to help you decide:

Complex Tax Situations

If you have a complicated tax profile, including owning a business or having multiple sources of income, a tax professional can navigate the intricate process.

Legal Concerns

In the event of suspected identity theft or fraudulent activity related to your lost ITIN, a tax expert versed in legal issues can provide essential guidance.

Filing Deadlines Approaching

If you’re close to tax filing deadlines and still without your ITIN, a specialist can expedite the recovery process to avoid penalties.

Inadequate Responses

Should you encounter unhelpful or vague responses from the IRS after attempting to retrieve your irs individual taxpayer identification number, a tax expert can act on your behalf.

A tax expert not only offers peace of mind but also ensures that your sensitive tax issues are handled professionally and promptly. Don’t hesitate to reach out for help when the situation seems overwhelming or beyond your expertise; a bit of expert advice can save you time and stress in the long run.

How Does a Professional Consulting Firm Get Your ITIN Number?

The IRS has authorized professional consulting agencies to obtain an individual tax number (ITIN) on your behalf. With the service you will receive from a quality and reliable consultancy agency, your ITIN application is processed before your individual application. Well, How to Find Your ITIN Number?

Consulting firms authorized to obtain your ITIN number apply the following:

- First, the consulting firm examines your situation. This determines whether you need to renew an ITIN. Then, if you need itin renewal an ITIN number, it analyzes whether you meet the conditions.

- The consultancy firm approves the accuracy of the documents to be sent with the ITIN application for primary and secondary applicants.

- The consultancy firm will assist you if the applications of your dependents are required. For this, the company from which you receive support will ensure that the original documents or copies approved by the issuing authority are sent to the IRS.

Consulting firms fill out the application form (IRS W-7 Form) for you and apply to the IRS on your behalf.

As a result; a professional consulting firm contacts the IRS directly on your behalf regarding your ITIN application and obtains your Individual Tax Number (ITIN) directly from the IRS.

Security Measures for Online ITIN Application to Find Your ITIN Number

Online services are equipped with security features to safeguard confidential data from unwanted access or misuse. Online security is something that all internet users should be mindful of, not only those who apply for ITIN numbers.

Among the security precautions are:

- Encryption: Uses encryption technology to secure data transmission between the user’s device and IRSservers. In this way, unauthorized persons are prevented from accessing important information such as personal information and documents.

- Secure Access: Log in with authentication. Users may be required to create an online account with strong authentication measures, such as multi-factor authentication (MFA), to verify their identity before accessing the application portal.

- Data Protection and Privacy Policies

- Secure Document Upload.

- Monitoring and Auditing:

- User Education

- Compliance Standards.

All measurements are for the benefit of users.

How Much Does It Cost to Get an ITIN Number?

The request for a number is free. Form W-7 must be submitted to the IRS to start the process of obtaining an Individual Taxpayer Identification Number (ITIN). How to find your ITIN number? There can be unavoidable expenses associated with the procedure that calls for payment. For instance, mailing expenses or certified copies of supporting documentation.

Frequently Asked Questions About to Apply for an ITIN

If you’ve ever wondered about the details of your Individual Taxpayer Identification Number, this FAQ on How to Find Your ITIN Number will guide you through the most common questions. From proving your ITIN and locating your tax ID, to requesting a copy of your ITIN letter, verifying your TIN, and understanding whether an ITIN can expire, these answers provide clear and practical steps. Whether you are applying for the first time or trying to recover a lost ITIN, this section will help you navigate the process with confidence.

How to show proof of ITIN?

You can show proof of ITIN by providing the IRS ITIN assignment letter (CP565) or any official tax documents (such as Form 1040) where your ITIN is listed.

How do I find my tax ID number?

Your Tax ID number (TIN) can be found on your IRS correspondence, previous tax returns, or by contacting the IRS directly at 1-800-829-1040.

Where can I get my ITIN number in person?

You can obtain or recover your ITIN in person by visiting an IRS Taxpayer Assistance Center (TAC) or through an IRS-authorized Certifying Acceptance Agent (CAA).

Can I get a copy of my ITIN letter? How to Find Your ITIN Number?

Yes. If you lost your ITIN assignment letter, you can request a replacement by calling the IRS or visiting a Taxpayer Assistance Center.

How do I verify my TIN number?

You can verify your Tax Identification Number by reviewing official IRS correspondence, checking your tax return documents, or contacting the IRS directly for confirmation.

Can I have both ITIN and SSN?

No. Once you receive a Social Security Number (SSN), your ITIN ,issued by the irs, is no longer valid for tax purposes and should not be used. So, to apply for a new ITIN, you must not have a SSN.

Does ITIN expire?

Yes. ITINs that are not used on a federal tax return for three consecutive years will expire. Also, certain ITINs with middle digits (e.g., 70–88, 90–99) may expire under IRS renewal rules.