The 147C letter is one of the most important details you need to know during the EIN application and approval process. If you are going to apply for your EIN number on behalf of your company, you will need to pay attention to the names of some documents. Of course, the EIN application process is more straightforward than you might think. You only need to know what the IRS requires and details like 147C letter IRS.

As ein-itin.com, we provide the necessary support during the EIN and ITIN application process. For your application to be successful, we will inform you about some issues. IRS letter 147C is also one of the details you need to be informed about.

Contents

What Is 147C Letter? 147C vs. CP 575

Services such as IRS 147C letter online are among the services we offer to you. Having all the details in your EIN or ITIN applications is also necessary. We also provide you with information that may be useful in this regard.

Before discussing the 147C letter, we wanted to look at the CP 575 letter. Once you know what these two documents mean for the IRS, you can better file EIN applications.

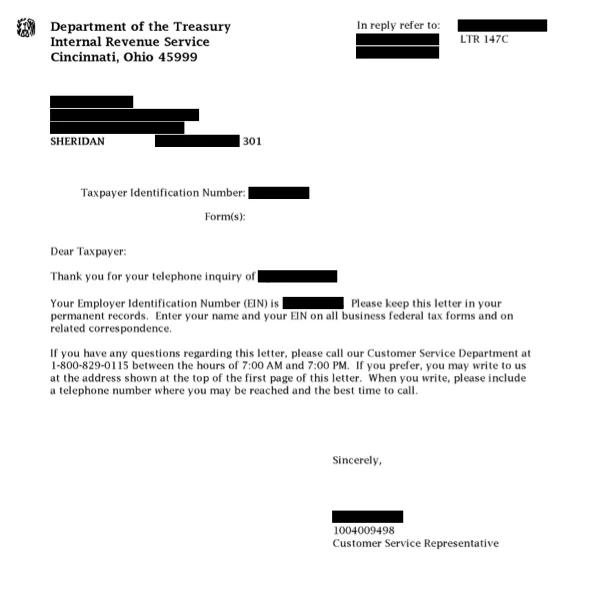

- CP 575 is one of the documents issued as an EIN approval letter. If you have applied for an EIN with the IRS, you will have been assigned an EIN number. The IRS will also send you this information on the SS4 fax form. This document is called an EIN approval letter, namely CP 575. However, the CP 575 is a one-time-only document generated on the computer to which the EIN is assigned.

- Although 147C actually means the same as CP 575, it is a different document in terms of operation. Since the CP 575 is a one-time-only document, you will not be able to get the CP 575 again in case of loss. It is possible to get 147C, which has the same functionality.

In short, the IRS assigns your EIN number after the EIN number application online process you have done through us. The documents used in this assignment are also CP 575 and 147C.

For What Purpose Is the 147C Letter Used?

147C letter IRS request is essential to obtain the EIN verification letter. Applications of people who have applied for an EIN before a certain period of time are usually finalized in 9-12 weeks. The applicant will receive a verification letter if the IRS accepts the application. This letter is sent to the address that the person has specified in the application form.

So you can use this letter in cases where an EIN is required. You can start making transactions with the letter 147C in the EIN application that you have made on behalf of your company.

How to Get 147C Letter? – Getting 147C Options: Fax or Mail

For a 147C letter request, you can call the IRS at 1 800 829 49 33. You can state that you need 147C with the call center directing you. When the IRS representative contacts you, you must also explain why you need the EIN verification letter from the other party. Your request will be processed after you answer the representative’s security questions.

You can request the 147C letter either by mail or fax. The IRS does not send such documents via e-mail for security reasons. Therefore, a 147C letter will be sent to the address or fax number you have confirmed.

- To request the 147C letter by mail, you must indicate this to the IRS representative. Your letter will be sent to the LLC’s address. However, it is important that you declare this to your representative in case of a change of address. The IRS representative will already ask you if the address is current. The 147C letter sent by post will usually arrive at your address in 4-6 weeks.

- In order to request a 147C letter by fax, it is sufficient to share your phone number with the representative. The IRS representative will request a reliable fax number from you during this process. You should also indicate that the phone number you have shared is reliable.

If you want to apply new EIN Application we are here to assist you to apply for your EIN.

You can Apply your EIN here.

Social Media

?nstagram

Ein-itin.com is a brand of Cohen Investment LLC, act as a Certified Acceptance Agency. Ein-itin.com provides professional services to prepare and apply for an Individual Tax Identification Number (ITIN) to submit through IRS. As a Certified Acceptance agent , Ein-itin.com prepares and submits applications for an Individual Taxpayer Identification Number (“ITIN”) on behalf of their applicants. Ein-itin.com tracks the application processing and notifies ITIN Applicants for their ITIN Confirmations. Ein-itin.com understands the applicant situation, inform before the ITIN Application process. Ein-itin.com helps to applicant to apply for their ITIN in a convenient way to avoid mistakes and rejection for ITIN Application. Any individual may hire us to prepare, submit and obtain his or her ITIN Number (via W7 Form) application to the IRS.