How Many EIN Numbers Can I Have? In the United States, there is no specific limit on the number of Employer Identification Numbers (EINs) an organization or individual can have. However, each EIN must be tied to a separate business entity or purpose, and the IRS recommends against obtaining multiple EINs for the same business without a valid reason. Generally, a sole proprietor only needs one EIN for their main business, while additional EINs may be necessary if they start new businesses, hire employees for different ventures, or operate multiple entities requiring separate tax reporting. Each EIN must be applied for individually and used solely for its designated business.

Each separate legal entity, such as a corporation, partnership, trust, or sole proprietorship, generally must have its own unique EIN. There are rules that a business must meet to have more than one EIN number. Among these;

| Conditions for having more than one EIN number | Details |

| Different Business Entities | Like corporations, and LLCs, each entity should have its own EIN. |

| Separate Divisions or Locations | If a business operates multiple divisions or locations each division or location may need its own EIN. |

| Succession or Change in Ownership | A new EIN may be obtained to reflect the change in ownership. |

| Trusts and Estates | Different trusts or estates typically require separate EINs. |

| Bankruptcy or Reorganization | A new EIN may be required for the reorganized entity. |

Contents

- 1 What is an EIN?

- 2 Is EIN and TIN the Same?

- 3 Difference Between TIN and EIN

- 4 When to Use an EIN? How Many EIN Numbers Can I Have?

- 5 How to Get an EIN Number?

- 6 Can You Use EIN Instead of SSN for the Apartment?

- 7 Advantages of Using EIN for Renting an Apartment

- 8 How to Use Your EIN to Rent an Apartment Successfully?

- 9 Frequently Asked Questions (How Many EIN Numbers Can I Have)

- 9.1 How Many Digits is an EIN Number?

- 9.2 Can You Have More Than One EIN Number? How Many EIN Numbers Can I Have?

- 9.3 Can a sole proprietor have more than one EIN?

- 9.4 How many EIN numbers can I have?

- 9.5 Can I change my business name and keep the same EIN?

- 9.6 Can I have two business names under one EIN?

- 9.7 Can I use my old EIN number for a new business?

- 9.8 How many EINs can an LLC have? How Many EIN Numbers Can I Have?

- 9.9 How many EINs can I apply for in one day? How Many EIN Numbers Can I Have

What is an EIN?

The EIN number refers to the employer identification number. It is used to identify businesses that will file business tax returns. An employer identification number is needed to open a business checking account, file business tax returns, and apply for necessary licenses.

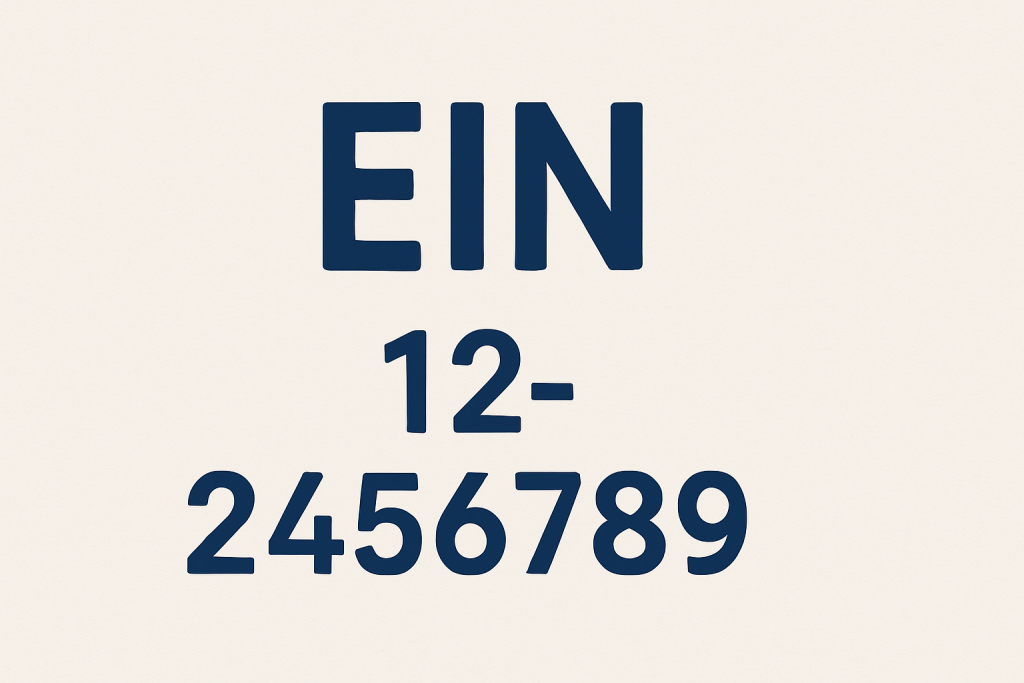

The EIN Number consists of nine numbers in the format XX-XXXXXXXX. An employer identification number may apply to an employer, sole proprietor, partnership, corporation, nonprofit organization, decedent’s estate, government agency, foundation, specified individuals, or business entity.

Is EIN and TIN the Same?

TINs (tax identification numbers) and EINs are not the same things. Although they are often confused with each other.

One of the reasons why many people confuse them is that Employer Identification Numbers are sometimes referred to as Federal Taxpayer Identification Numbers. The most important difference to know is that tax identification number is an umbrella concept. Employer identification number is just one of the numbers covered by this umbrella term. The umbrella concept consists of different identification numbers.

Because personal taxes and business taxes are different, it is important to understand the differences between TIN and EIN numbers.

TINs used by the IRS come in various formats, but they do not all serve the same purpose. Some of the numbers in different formats indicate business taxes on tax IDs, and some can indicate personal taxes.

Difference Between TIN and EIN

A tax identification number should be used when you need to fill out personal or business documents. Obtaining multiple eins can be written as tax identification numbers; The most commonly used of these numbers include TIN and employer identification numbers.

TIN and EIN, which are used interchangeably by people who do not know the difference, are not the same thing. There are fundamental differences between the two.

While tax identification number is a general tax identification number, EIN number is a specially prepared employer identification number. This makes the EIN number a type of TIN. However, the Taxpayer Identification Number can also identify other taxpayer identification numbers in addition to the employer identification number.

When to Use an EIN? How Many EIN Numbers Can I Have?

EIN, an Employer Identification Number issued by the IRS to corporate entities operating in the United States, is primarily used to identify and report companies. Opening bank accounts, obtaining permits and licenses, and managing employee payrolls are also necessary. How Many EIN Numbers Can I Have?

Businesses that meet certain guidelines set by the IRS must have an employer identification number.

Some examples of businesses that need employer identification numbers include:

- Pay wages to employees

- Have a Keogh plan

- Operate as a partnership or cooperation

- Estates and real estate mortgage

- Non-profit organizations

- Farmers’ cooperatives.

How to Get an EIN Number?

After registering as a limited liability company (LLC), the business must obtain an employer identification number from the IRS to get an EIN immediately.

An employer identification number is another name for a business’s nine-digit federal tax identification number. If you have one or more employees, you are required to obtain an employer identification number. If you are a single-member LLC, you do not need to get a number for your business, but having one can still be important to the operation of the business.

LLCs are assigned an employer identification number by the IRS. After identity verification, the EIN number can be obtained quickly and free of charge. There are several ways to obtain an EIN Number by mail, phone, or fax.

Can You Use EIN Instead of SSN for the Apartment?

A business that is not a sole proprietorship must have an Employer Identification Number or EIN. You can use the EIN number to rent an apartment. Just as a Social Security number is for personal life, an Employer Identification Number is for business purposes. It helps increase your credit score for opening a bank account, filing taxes, and much more. Individuals can also use this number for personal transactions, including apartment rentals.

The Employer Identification Number is traditionally associated with businesses and its application for personal use, such as apartment rentals, has become popular.

It is not against the law to use an EIN number to rent a business space. Since it is both a workspace and a personal space, it is a must for those who work from home. It is often easier to remove the Employer Identification Number for use only in business transactions. There are laws one must know to use the EIN number. It is necessary to know the advantages and difficulties it provides. The numbers are intended to be used for commercial purposes only. He/she should not use the Employer Identification Number for personal purposes.

Advantages of Using EIN for Renting an Apartment

As a business owner, there are many advantages to using an EIN number to rent an apartment. How Many EIN Numbers Can I Have? The biggest benefit of using an EIN is convenience.

The advantages of using an EIN number include;

| Advantages | Details |

| Tax Advantages | Allows rental payments to be deducted from business tax. |

| Privacy protection | Using your Employer Identification Number ensures that your Social Security Number (SSN) is not disclosed to the landlord. |

| Reliability Increase | Increases the reliability of your business. |

| Financial Separation | This makes it easier to track business expenses. Provides financial clarity by simplifying IRS audits. |

| Convenience | Not needing proof of residence simplifies administrative procedures and makes it easier to rent in a state other than your business location. |

How to Use Your EIN to Rent an Apartment Successfully?

Renting an apartment using your EIN can be successful if you approach it professionally. Start by clearly explaining to the landlord that you are self-employed or a business owner, which legitimizes using your EIN instead of a personal Social Security Number. Providing a brief overview of your business, including its type, duration, and size, can help build trust.

It is essential to document everything in writing, from rental applications to the lease agreement and any supporting documents. Preparing a concise business profile for the landlord can serve as a helpful reference and demonstrates your seriousness and organization. Treat the entire process as a formal business transaction to maintain professionalism.

You should carefully review and understand the lease terms, and seek clarification on any uncertainties. Consulting legal or real estate professionals can help prevent mistakes and ensure the process goes smoothly. Being thorough and transparent increases your chances of successfully renting an apartment using your EIN.

Frequently Asked Questions (How Many EIN Numbers Can I Have)

When starting or managing a business in the United States, the Employer Identification Number (EIN) plays a crucial role in identifying your business for tax and legal purposes. Many business owners have questions about EINs. How Many EIN Numbers Can I Have?

Such as how many digits they contain, whether a single person can have multiple EINs, and how EINs relate to different business structures. This FAQ guide provides clear answers to these common questions, helping you understand the rules and best practices for obtaining and using EIN numbers.

How Many Digits is an EIN Number?

EIN is an important number for most businesses in the US to have. It stands for Employer Identification Number and it is used for many things like filing taxes and opening a business bank account. Regarding your EIN number, you may have many questions, such as: “how many digits is an EIN number?”.

Employer Identification Number (EIN) is a 9-digit number. The format that an EIN has should be: XX-XXXXXXX. When you receive your 9-digit EIN number, you can note it down in a safe place and make sure to avoid losing it.

Can You Have More Than One EIN Number? How Many EIN Numbers Can I Have?

An EIN number is used for identifying a business entity. Along with processing taxes, it is used in other important processes like running payroll. So an EIN is an important number to have for most corporate entities in the US.

About this number, you may be wondering: “can you have more than one EIN number?”. EIN numbers are specific for each business entity that is required to have it. Therefore, if you have more than one business entity that is required to have this number, you should get one for each. Basically, a person can apply to get more than one EIN number, if we are talking about multiple corporate entities.

Can a sole proprietor have more than one EIN?

Yes, a sole proprietor can have more than one EIN, but only under certain circumstances. Generally, a sole proprietor needs only one EIN for their business. However, additional EINs may be required if they open a new business with different business activities, hire employees for separate ventures, or operate multiple businesses that require distinct reporting. Each EIN must be obtained separately from the IRS and used only for its designated business purpose.

How many EIN numbers can I have?

There is no strict limit to the number of EINs an individual or business can obtain, but each EIN must be tied to a separate business entity or purpose. Generally, a sole proprietor only needs one EIN for their main business. Additional EINs may be required if you start new businesses, have different tax structures, or operate separate ventures that need distinct reporting. Each EIN must be applied for individually through the IRS and used only for its assigned business.

Can I change my business name and keep the same EIN?

Yes, you can generally keep the same EIN if you change your business name without changing the business structure. You must notify the IRS of the name change by filing the appropriate forms or updating your next tax return.

Can I have two business names under one EIN?

Yes, a business can operate under multiple trade names or “DBAs” (Doing Business As) using a single EIN. However, each DBA must be registered according to state or local regulations, and the EIN remains tied to the legal entity.

Can I use my old EIN number for a new business?

No, an EIN is assigned to a specific legal entity and cannot be reused for a completely new business. Each new business entity must apply for its own EIN, even if you previously had one for a different venture.

How many EINs can an LLC have? How Many EIN Numbers Can I Have?

An LLC typically needs one EIN per legal entity. If the LLC has multiple divisions that are treated as separate entities for tax purposes, it may require additional EINs. Otherwise, all operations under the same LLC use the single EIN. You should need a new ein for a new business purpose.

How many EINs can I apply for in one day? How Many EIN Numbers Can I Have

The IRS does not specify a strict daily limit, but each EIN application must be unique and for a separate business entity or purpose. Attempting to apply for multiple EINs for the same business on the same day may be rejected.